We all know that the best food has been crafted to perfection. However, if you toss the contents of your fridge in a pan, there’s no guarantee it will turn out well. You could create a delightful dining experience for your guests, or leave them with a bad taste in their mouth. Literally. A successful business owner is like a professional chef, they need a recipe to cook from. It’s like throwing spaghetti against a wall and hoping it sticks, you may have some success, but it’s unlikely your agency will thrive without decisions based on real data.

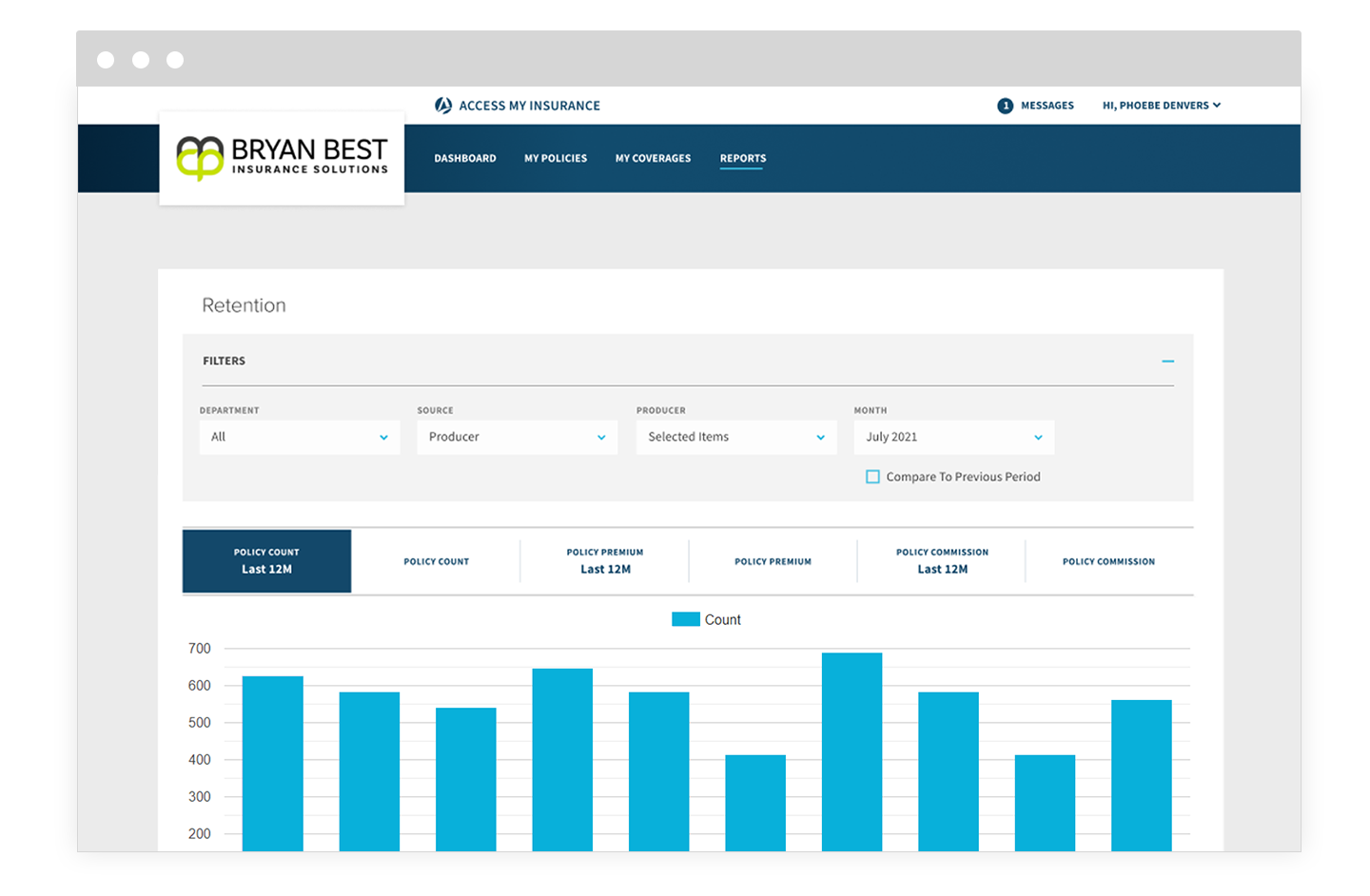

With Access My Insurance (AMI) you have the recipe for success. We all keep a close eye on our net-new business and retention, but does your current system have the tools to increase them automatically? In AMI you have access to tools aimed at these Key Performance Indicators (KPIs) that start working for you on day one. By using these no-touch tools we will help you to reach your goals without leaving money on the table. Our fully integrated web portal allows you to track and run reports on all of your data so you can watch your business grow.

Improve Retention and Net-New Business With Up-To-Date Data

We all know that cross-selling current customers is much less expensive than getting a new customer. According to Work Zone, the best way to increase customer loyalty and improve retention is to provide high quality goods and services and an excellent customer experience. The real question is how much time and work will it take to improve your agency’s retention rate? Luckily, we already have a plan to take care of that for you.

Small intermittent changes can make a huge difference, and we make that easy within AMI. We already have curated content written and ready to go on the day you sign up. All you have to do is turn on our ready-made emails and your chances of missing a policy expiration or cross selling opportunity are drastically reduced. With automated marketing triggers, everything is set up to run in the background while you focus on the tasks that need a more hands-on approach. With all of this set up, you can harness the power of our reports to make informed business decisions with the most current data.

Understanding the Net-New Business Dilemma

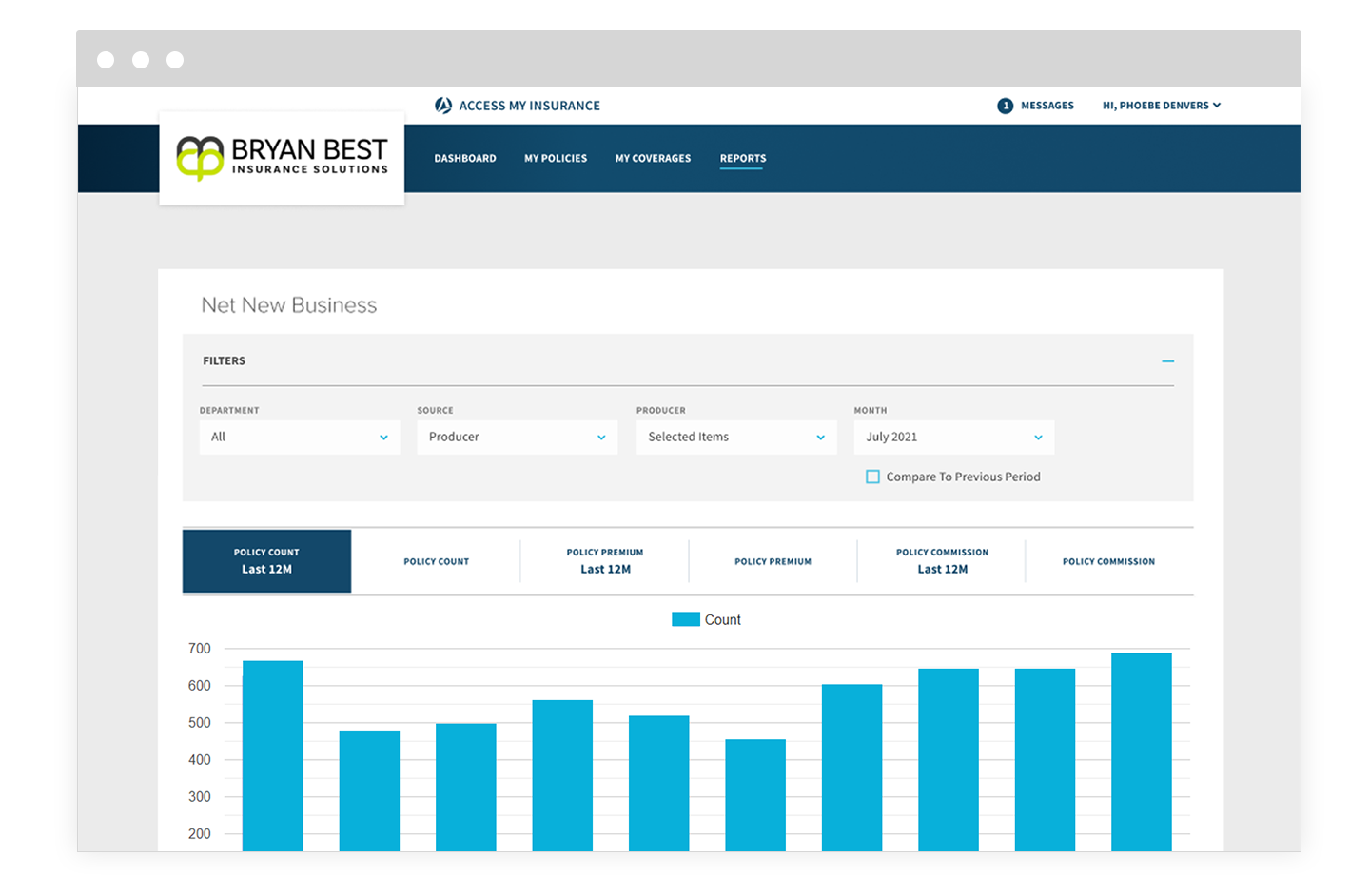

By providing you tools to maintain the business you already have, you can now focus on getting new business. The dilemma is that other systems can’t show you your net-new business. They leave that calculation up to you, and without identifying probable rewrites, their numbers are simply not accurate. Other systems will just show you one cancellation and a new policy, but AMI knows the difference.

Keeping track of all these numbers manually can be as complicated as a police evidence board. The good news is that we make tracking your net-new business easy. Feel free to cut that red string down my friend. We’ve separated out net-new business within our reports as well. You won’t need that pen and scratch paper anymore, because we use algorithms smart enough to do the heavy lifting for you. As a result, you are able to get a quick snapshot of how your agency is doing. This makes it easy to understand the health of your business and opportunities for growth.

The Chef’s Kiss

By using these tools, we help you make the most informed decisions on what’s working and what needs to be adjusted. It’s like using the exact measurements on a recipe card instead of hoping your guess-timations are going to turn out right. We take all the guesswork out of it by putting your data front and center. You can use it to make informed decisions about the future of your business. To make it even easier, we have tools that start working for you on day one. These tools help you increase your retention, and grow your business with little to no effort on your part.

If you aren’t using Access My Insurance, you are leaving money on the table and creating more work for your agency. We are constantly adding tools and curated content that help you to manage and grow your business with minimal effort. So what are you waiting on? Contact us today and learn more about our reports and the tools that make up our all-in-one solution for your agency.